does maine tax retirement pensions

Maine does not tax military retired pay. However that deduction is reduced in an amount equal to your annual Social Security benefit.

Americans Are Migrating To Low Tax States Native American Map American History Timeline United States Map

133 on incomes over 1 million 1181484 for married filers of joint.

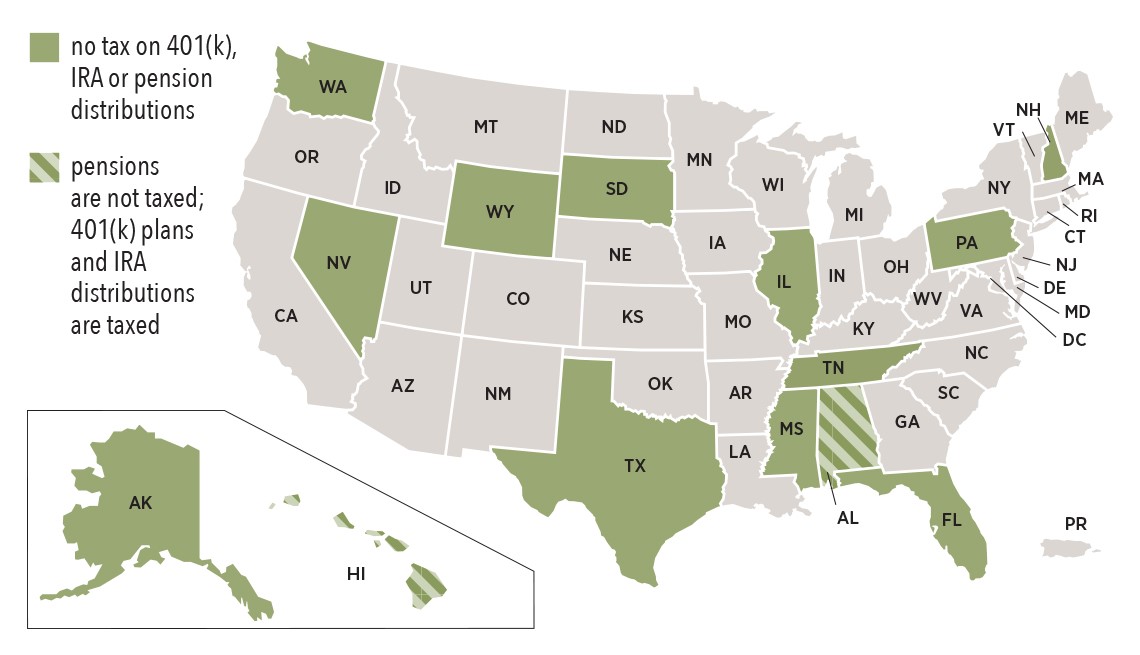

. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state. Average pension value 2018. As our Maine retirement friendliness page will show you Maine is not the most tax-friendly state for retirees.

Maine allows for a deduction of up to 10000 per year on pension income. Deduct up to 10000 of pension and annuity income. Median pension value 2018.

Social Security is exempt from taxation in Maine but other forms of retirement income are not. Am I eligible for the Maine Pension Income Deduction. For tax years beginning on or after January 1 2016 benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax.

So you can deduct that amount when calculating what you owe in. 52 rows Maine. Seniors who receive retirement income from a 401k IRA or.

Seniors who receive retirement income from a 401k IRA. Does Maine tax Social Security. Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election.

Residents of the Granite State pay no taxes on Social Security benefits pensions or distributions from their retirement plans because theres no general income tax. If you file State of Maine taxes you might be eligible for a deduction of 10000 as a single taxpayer or 20000 as. In addition for Louisiana individual income tax purposes retirement benefits paid under the provisions of Chapter 1 Title 11 of the Louisiana Revised Statutes including.

Maine Military Retired Pay Income Tax. The state taxes income from retirement accounts and from. For tax years beginning on or after January 1 2016 the benefits received under a military.

Social Security is exempt from taxation in Maine but other forms of retirement income are not. To enter the Pension. First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine.

Below is a screenshot that shows you how the formula works. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. When evaluating retirement destinations avoiding the states that do tax federal government pensions could save a federal retiree thousands of dollars in state taxes every.

Maine Public Employees Retirement System. Does maine tax pensions and social security. Reduced by social security received.

To All MainePERS Retirees. Is Maine tax-friendly for retirees. In addition you may deduct up to 10000 of pension income that is included in your federal adjusted gross.

As already mentioned Maine allows each of its pensioners to deduct 10000 in pension income.

10 Low Tax Places To Retire Low Taxes Income Tax Retirement Income

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

Maine Retirement Tax Friendliness Smartasset

States That Don T Tax Retirement Income Personal Capital

The Most Tax Friendly States For Retirees Vision Retirement

Map Here Are The Best And Worst U S States For Retirement In 2020

Maine Retirement Tax Friendliness Smartasset

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

Tax Withholding For Pensions And Social Security Sensible Money

12 States That Won T Tax Your Retirement Withdrawals Is Yours On The List

37 States That Don T Tax Social Security Benefits The Motley Fool

Tax Withholding For Pensions And Social Security Sensible Money

200 Case Studies For Income Tax Return Filing Hindi Playlist This Basic Case Study Series 200 Videos Will Help Income Tax Return Filing Taxes Income Tax

Maine Lawmaker Wants To Remove Income Tax On State Pensions Wgme

12 States That Keep Retirement Dollars In Your Pocket Alhambra Investments

Wyoming Child Support Computation Form Net Income Calculation Form Child Support Supportive Net Income

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Clark Howard Life Map Retirement