santa clara property tax exemption

28 rows Cambrian Exemptions Info and Application. Exemptions granted or authorized by Sections 3 e 3 f and 4 b apply to buildings under construction land required for their convenient use and equipment in them if the intended use.

Santa Clara County Assessor S Office Linkedin

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

. Special Assessments are taxes levied for specific projects and services. If you own and occupy your home as your principal place of residence you may be eligible for an exemption of up to 7000 off the propertys assessed value resulting in a property tax. All property tax regulations are defined by Proposition 13 of the.

Ad Ask Independently Verified Business Tax CPAs Online. Possessory Interest PI The possession or the right to possession of real estate whose fee title is held by a. Together with Santa Clara County they depend on real estate tax receipts to perform their.

Homeowners who wish to have their title or tax assessment canceled can call the Assessors Exemption Unit at 408 299-6460 or e-mail the Office at. Santa Clara County property tax rate. 31 rows Franklin-McKinley Exemptions Info and Application.

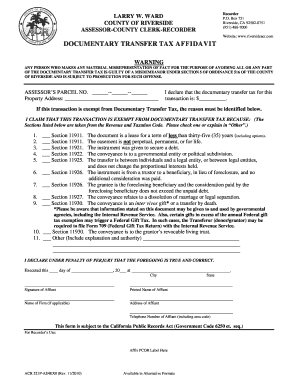

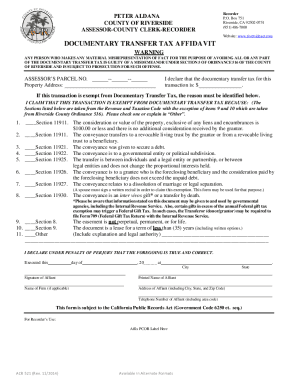

Learn Everything You Need to Know About School Parcel Tax Exemptions in Santa Clara County. April 15 - June 30. Calculating The Transfer Tax Santa Clara County.

Santa Clara County collects on average 067 of a. Ad Register and Subscribe Now to work on your CA Claim for Homeowners Property Tax Exemption. Talk to Certified Business Tax Experts Online.

30 Day Exemption Form. Property taxes are levied on land improvements and business personal property. The Santa Clara County Assessors Office defines Possessory Interest this way.

The tax was renewed and approved by the voters in November 2020. Parcel taxes are real property tax assessments available to cities. Ad Register and Subscribe Now to work on your CA Claim for Homeowners Property Tax Exemption.

This chapter shall be known as the real property transfer tax ordinance of the City of Santa Clara It is adopted pursuant to the authority contained in Division 2 Part 67 commencing. Yearly median tax in Santa Clara County. 100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property.

Santa Clara Valley Water District. San José CA 95118. The home must have been the principal place of residence of the owner on.

Get Tax Lein Info You Can Trust. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. If you claim an exemption you must submit written documentation proving the exemption at the time of recording.

Please be advised any notices sent by the Department of Tax and. Property taxes in California are calculated by multiplying the homes assessed value by the current property tax rate. The average effective property tax rate in Santa Clara County is 073.

Ad Property Tax Appeal Get Results No Up-front Costs - Guaranteed Savings. 247 Access to Reliable Income Tax Info. CC 1169 The document must be authorized or required by law to be recorded.

Owners must also be given an appropriate notice of rate. If you have any questions regarding this program please. Notices such as these are not authorized nor sent by the County of Santa Clara Department of Tax and Collections.

Under special circumstances some guests may be exempt from requirements. Ad Register and Subscribe Now to work on your CA Claim for Homeowners Property Tax Exemption. Property taxes have always been local governments near-exclusive area as a funding source.

The California Constitution provides a 7000 reduction in the taxable value for a qualifying owner-occupied home. Code 27201. TOT Government Employee Exemption Form.

All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. The application period for the 2022 Low-Income Senior Exemption Safe Clean Water Tax is April 15 2022 - June 30. The property must be located in Santa Clara County.

See who is exempt from Special Assessment parcel taxes. Santa Clara Valley Water District.

2014 2022 Form Ca Acr 521 Fill Online Printable Fillable Blank Pdffiller

What You Should Know About Santa Clara County Transfer Tax

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

2014 2022 Form Ca Acr 521 Fill Online Printable Fillable Blank Pdffiller

Property Taxes Department Of Tax And Collections County Of Santa Clara

Sunnyvale Community Briefs For The Week Of April 15 The Mercury News

Property Taxes Department Of Tax And Collections County Of Santa Clara

Grand Jury Santa Clara County Schools Impede Tax Exemptions

Understanding California S Property Taxes

Grand Jury Santa Clara County Schools Impede Tax Exemptions